It’s certainly not a comfortable feeling if you don’t. But what’s behind that feeling of unease?

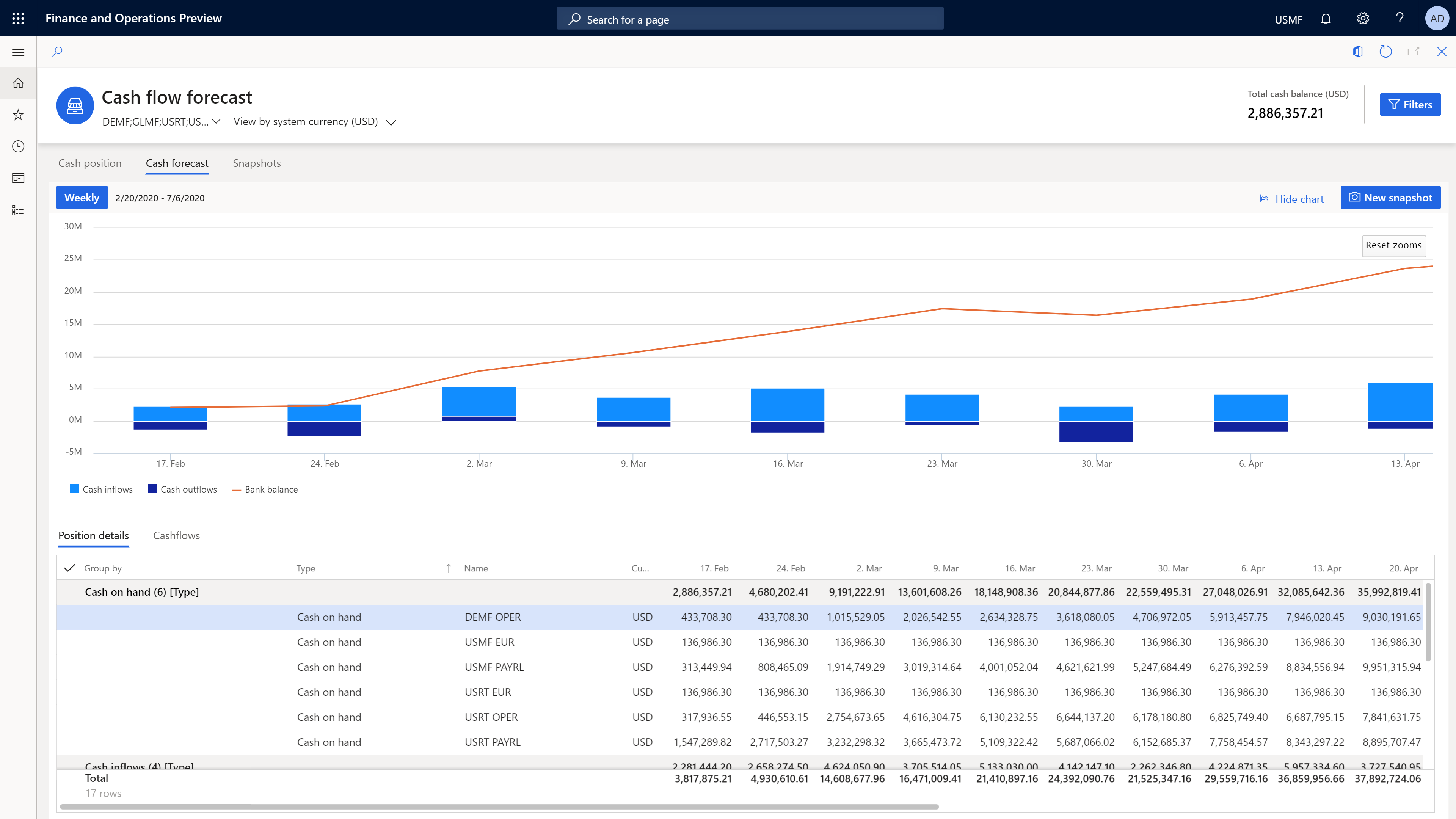

When it comes to financial reporting it’s mostly about what’s happened in the past – and you can’t do a lot about what has already happened. That also leads to discomfort. We help organisations think about leading indicators – what measures can be put in place to see what next month is going to look like. Rather than concentrating on what’s happened, it’s often more valuable to see what’s coming down the road.

Or maybe it’s the cross-functional collaboration to bridge the gap between operational and financial planning. 76% of CFOs say that’s a problem for their businesses. Financial planning is coming up with budgets and forecasts, which are undoubtedly useful, but they don’t tell you how to plan for your operation, and what is required to actually run the business. Sound familiar?

The financial numbers may go up or down, but feeling in control is about accuracy, timeliness and having the right measures.

As a world class finance function, this is what you want to be able to say about yourself:

How would you rate yourself against these statements?

It’s a journey. But in getting there, you might meet some bumps in the road. Effective and integrated finance and operational departments are needed to help you achieve world-class success.

If you’re struggling to reach this point, it’s probably one or more of these factors that’s holding you back:

We see many organisations that look at financial reporting as a compliance activity rather than as a business planning tool. At the end of each year every business needs to produce financial reports – but that doesn’t help them to plan, or tell them what they need to do to be successful.

It’s also often the case that organisations take until the middle of the following month to produce last month’s information, and at that point you’ve lost half a month to action the numbers. You miss the opportunity to course-correct.

Here at Ardenfort, we help you get to the point where numbers are available immediately after month end. We also help you establish efficient processes and automate tasks so that your finance team has the freedom to perform value-added analysis for the overall benefit of your business.

”When it comes to subscriptions, adding tiers to your offerings also adds financial complexity. The more tiers and add-ons that are applied to a subscription, the more difficult it becomes for a business to handle that financially. Because of this, when a company does not have the right technologies in place, they tend to over-simplify their subscription offerings, otherwise it becomes too difficult for them administratively. As a result, businesses are limiting their offerings, not packaging products in the optimum way, and most significantly, not offering the tiers of services they know their customers would like.

Edward Borg Grech

If you’d like to speak to us about how we can help you ensure greater financial control, please get in touch.

Call us on +44 20 8895 6598 or fill out the form below.

UK Headquarters

Finsgate 5-7 Cranwood Street,

London EC1V 9EE, UK

T : +44 20 8895 6598

E : info@ardenfort.co.uk

Malta Offices

Ardent Business Centre, Triq l-Oratorju,

Naxxar NXR 2504, Malta